> Blogs > Analyzing American Hookah Market Trends: Data and Insights for 2025

Analyzing American Hookah Market Trends: Data and Insights for 2025

Core keywords:American hookah market trends, handmade hookah market

Understanding the Key American Hookah Market Trends

The U.S. hookah industry has undergone significant transformation over the past decade, evolving from a niche cultural practice into a mainstream social and commercial phenomenon. In 2025, understanding American hookah market trends is crucial for manufacturers, lounge owners, and consumers alike. This article examines the market through data, regulatory shifts, and product segmentation, with special attention to the growing handmade hookah market.

Before diving into the data, it’s important to outline what defines current American hookah market trends. These trends reflect the industry’s shift from a niche cultural pastime to a structured lifestyle segment, driven by changing consumer demographics, lounge proliferation, and product innovation. This context sets the stage for analyzing the market’s size, segmentation, and future outlook.

Market Size and Growth Dynamics

According to a 2024 report by Grand View Research, the U.S. hookah market was valued at approximately USD 163 million in 2023, with a projected compound annual growth rate (CAGR) of 5.2% through 2030【1】. This growth is driven by three primary factors:

Cultural normalization of hookah smoking among younger demographics, especially urban millennials and Gen Z.

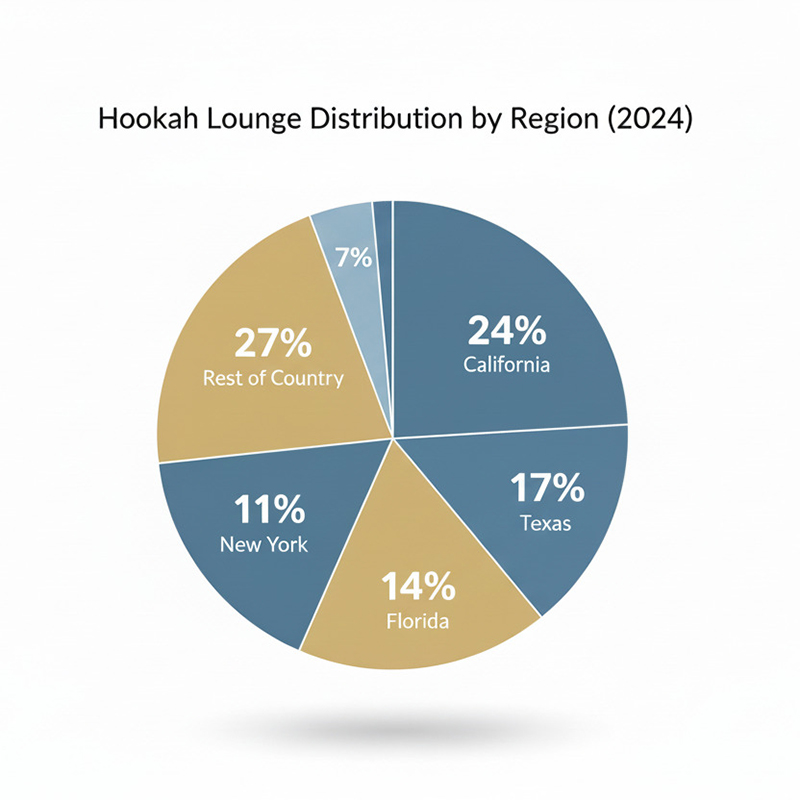

Lounge proliferation, with an estimated 2,500+ registered hookah lounges nationwide, concentrated in California, Texas, Florida, and New York【2】.

Product diversification, including the rise of designer glass hookahs, portable models, and premium handcrafted sets.

The American hookah market trends indicate a steady shift from purely social consumption toward lifestyle and collectible use — similar to how specialty coffee or craft beer markets evolved in earlier decades.

Regional Distribution of Hookah Lounges in the U.S.

Although hookah consumption is nationwide, the American hookah market trends reveal a clear geographic concentration. Urbanized states with diverse cultural communities and younger populations dominate the landscape.

Consumer Demographics and Behavior

Recent surveys (Hookah Market Monitor, Q4 2024) show that 42% of active U.S. hookah consumers are between the ages of 21–30, with university towns and metropolitan areas showing the highest lounge density【3】.

Urbanization is a key driver: 68% of frequent hookah users live in cities with populations over 500,000.

The gender balance is gradually shifting, with female consumers now representing 38% of the market — up from 26% in 2015.

Product personalization is becoming a major factor, with 1 in 4 buyers opting for custom or handmade hookah products.

The rise of customization ties directly into the handmade hookah market, which appeals to consumers seeking cultural authenticity, aesthetic value, and longer product lifespan.

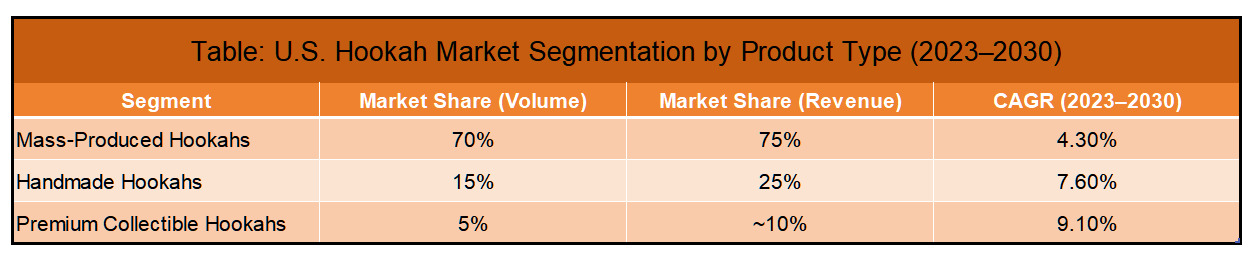

Product Segmentation: Handmade vs. Mass-Produced

The handmade hookah market represents a growing niche in the broader U.S. landscape. While mass-produced aluminum or acrylic hookahs dominate unit sales (around 70%), handmade glass and metal hookahs account for 25% of total revenue despite lower volumes【4】.

The handmade segment’s higher CAGR reflects consumer willingness to pay premium prices for artisanal craftsmanship and unique designs. Brands that combine traditional techniques with modern aesthetics are gaining traction in urban boutique stores and online direct-to-consumer platforms.

Regulatory Landscape and Taxation

Regulation remains a defining factor in American hookah market trends. Hookah products are regulated by the U.S. Food and Drug Administration (FDA) under the tobacco product category, but taxation and labeling rules vary significantly by state.

Excise taxes on hookah tobacco range from 15% to over 90%, depending on jurisdiction【5】.

Indoor smoking bans affect lounge operations, with stricter enforcement in states like California and New York.

Import regulations for handmade hookahs, particularly from the Middle East and Europe, require compliance with material safety standards and customs documentation【6】.

These variations create operational challenges but also drive innovation, especially among domestic handmade hookah producers who are less affected by import restrictions.

Future Outlook

Looking ahead, several key American hookah market trends are expected to shape the next 5 years:

Sustainability and eco-consciousness will influence product materials, with more brands exploring recyclable glass and lead-free metals.

Lounge hybridization (hookah + café or hookah + co-working spaces) will cater to evolving social behaviors.

Digital marketing and influencer collaborations will continue to drive Gen Z adoption.

The handmade hookah market will expand through small-batch production, cultural branding, and designer collaborations【6】.

The U.S. market is evolving from a niche cultural practice into a structured lifestyle segment, with steady growth across both mass and artisanal sectors.

🔍Conclusion

The American hookah industry is entering a stage of strategic maturity. With an expanding consumer base, growing demand for customization, and evolving regulations, understanding American hookah market trends is essential for stakeholders.

The handmade hookah market stands out as a high-growth segment that blends cultural heritage with modern consumer tastes — a trend likely to define the industry’s next decade.

【2】 Hookah Market Monitor. U.S. Hookah Lounge Landscape Report Q4 2024 (Yelp business directory aggregation).

【3】 Hookah Market Monitor. Consumer Demographics Report, Q4 2024.

【4】 Industry estimates based on Grand View Research data and U.S. Census Bureau trade data (2022–2024).

【5】 CDC. State Tobacco Tax Rates and Policies, 2023.

【6】 U.S. Census Bureau. Trade Data: Hookah & Smoking Accessories Imports 2022–2024.